Understanding Japan's two-tier pension system

Everyone between 20 and 60 in Japan must legally enrol in the National Pension system and pay contributions.

This article was originally published on the website of Posse Nippon, the publisher of Small Business Japan, prior to the launch of Small Business Japan (October 2024). Articles published before September 2024 have been edited and transferred to this site.

Basic knowledge about the Japanese social insurance system – 1/2

Overview of the Japanese pension system

Japan's public pension system consists of two tiers:

1) The National Pension (国民年金, Kokumin nenkin): A public pension that all residents aged 20 to 60 belong to.

2) The Employees' Pension (厚生年金, Kosei nenkin): This covers those working for companies and organisations.

There's also a third tier (company pensions and iDeCo), but these are optional. Everyone in Japan will be part of at least one of the first two tiers, and possibly both. This article focuses on these essential parts of the system: the National Pension and the Employees' Pension.

To understand how they work, let's look at the big picture.

When you reach 65, you'll receive the Old-Age Basic Pension (老齢基礎年金, or Rorei kiso nenkin). If you've paid into the Employees' Pension, you'll also get the Old-Age Employees' Pension (老齢厚生年金, or Rorei kosei nenkin) on top of that, increasing your total benefits.

(1) National Pension and Old-Age Basic Pension

a. National Pension

Once you enroll, you'll receive a unique, lifelong Basic Pension Number (基礎年金番号, Kiso nenkin bango).

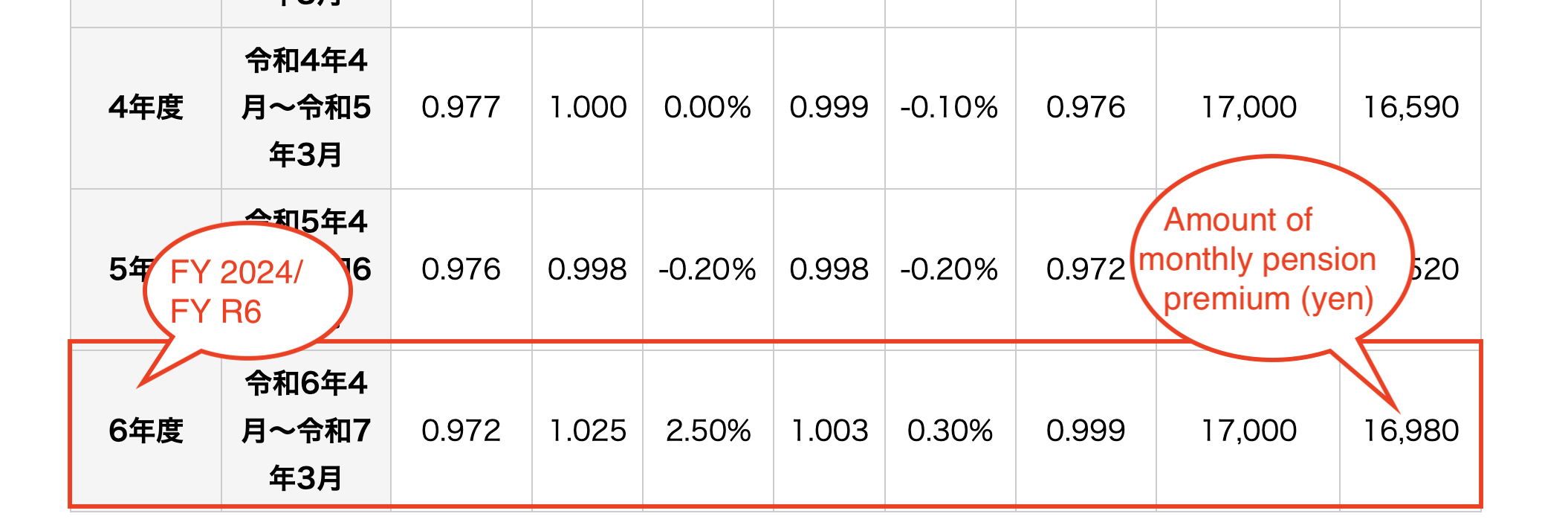

The monthly premium is adjusted annually. (See the table below. The original version can be found on the Japan Pension Service website)

b. Old-Age Basic Pension

You can receive an Old-Age Basic Pension from age 65 if you've paid into the system for at least 10 years (this minimum was shortened from 25 years in 2017). The amount you receive depends on how long you paid into the National Pension (and the Employees' Pension if you were also a member).

c. Voluntary enrolment system

If you haven't paid into the National Pension for at least ten years, or you want to increase your pension amount, you can join the Voluntary Enrollment System. This option is only available to those in the National Pension, not the Employees' Pension. You can enroll starting the day before your 60th birthday.

(2) Employees' Pension and Old-Age Employees' Pension

a. Employees' Pension

In addition to the National Pension, most employees in Japan are also covered by the Employees' Pension. All corporations and private workplaces with more than five employees are legally obliged to enroll in the Employees' Pension (厚生年金, Kosei nenkin).

This system covers a wide range of employees, including those in private companies, public servants, and private school teachers who belong to mutual aid pension schemes. If you work for a company in Japan, you're likely enrolled in the Employees' Pension.

b. Old-Age Employees' Pension

If you're eligible for the Old-Age Basic Pension and have paid into the Employees' Pension scheme, you'll also receive the Old-Age Employees' Pension from age 65.

The Employees' Pension works in conjunction with the National Pension to provide a more substantial retirement income. Think of it this way:

Tier 1: National Pension - This provides your basic pension.

Tier 2: Employees' Pension - This adds an extra layer of benefits on top of the National Pension.

References:

‘National Pension System.’ Japan Pension Service. Last accessed: October 16, 2024.

‘老齢基礎年金の受給要件・支給開始時期・年金額’ (Eligibility Requirements, Payment Start Date, Pension Amount for the Old-Age Basic Pension. In Japanese). Japan Pension Service. Last accessed: October 16, 2024.

'国民年金保険料の額は、どのようにして決まるのか?' (How is the monthly premium for the National Pension calculated? Japan Pension Service. Last accessed: October 16, 2024.

'任意加入制度' (Voluntary Enrolment System in Japanese). Japan Pension Service. Last accessed: October 16, 2024.