HR-Focused MHLW Grants 3/3: Business funding for productivity initiatives

This MHLW grant supports spending on measures that enhance production efficiency for companies implementing 'Work Style Reform' to boost productivity.

'Work style reform' promoting grant up to ¥2m

MHLW offers a grant to support companies implementing 'Work Style Reform' (Hatarakikata-kaikaku). This grant can fund various expenses related to improving work-life balance, such as employees' training and implementing new software and hardware to streamline operations and boost productivity. Eligibility is based on achieving specific 'Outcome Goals' related to the Agreement on Overtime and Holiday Work ('36 Agreement' or 36 Kyotei), which regulates overtime and holiday work.

In Japan, the terms 'hojokin' (補助金) and 'joseikin' (助成金) both translate to 'subsidy' in English, particularly in the context of the government programme. For clarity, in Small Business Japan, we will use 'subsidy' when referring to hojokin (typically from the METI) and 'grant' when referring to joseikin (typically from the MHLW).

We sought the expertise of Mr Tomohiko Narai, a sharoshi, to understand the procedures and key points.

You can also contact Mr Narai for further assistance via his corporate website.

Act now and complete by the end of March to qualify for next fiscal year's grant

[Summary] Companies can receive grants for initiatives that improve productivity, reduce working hours, and encourage employees to take annual leave.

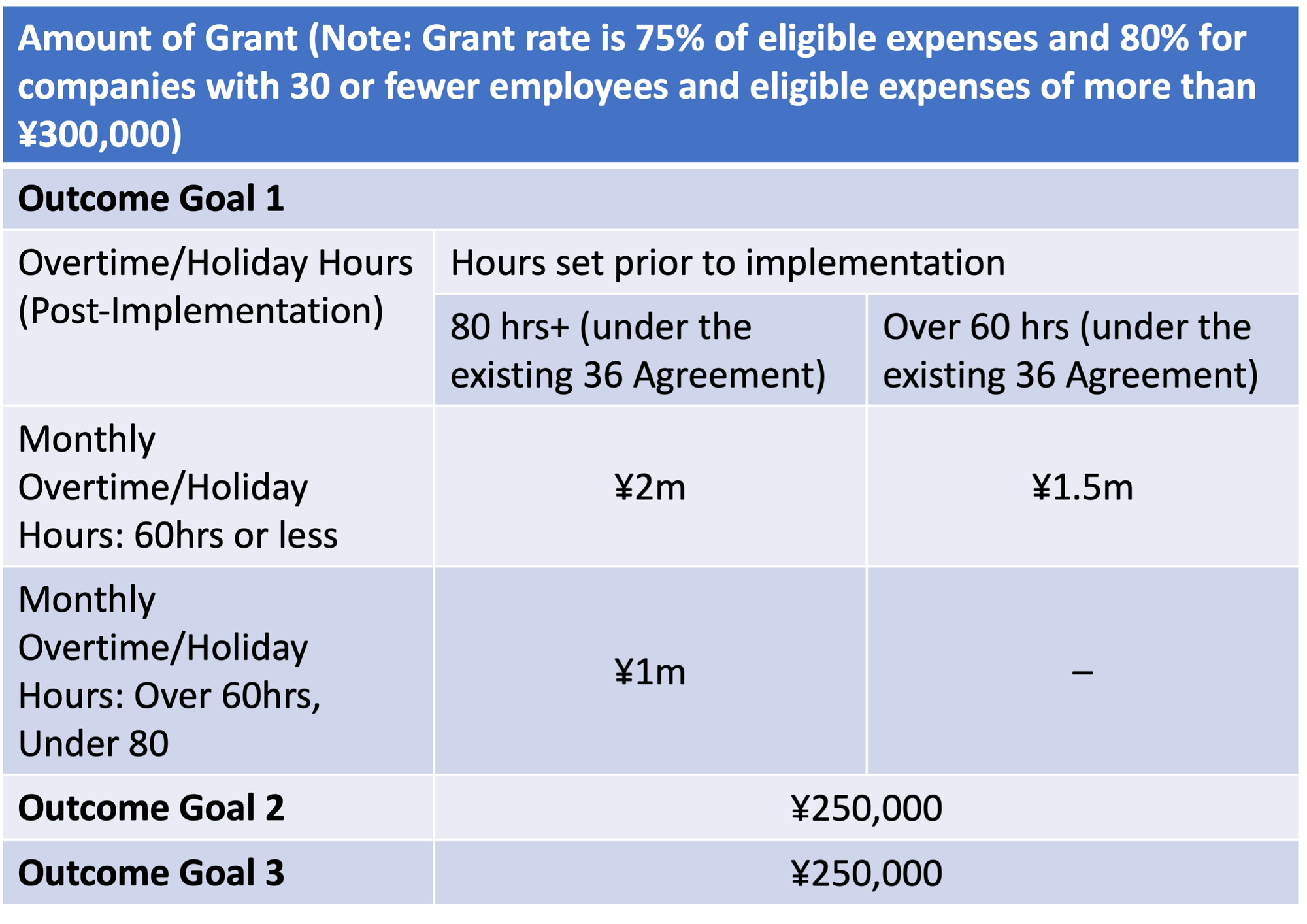

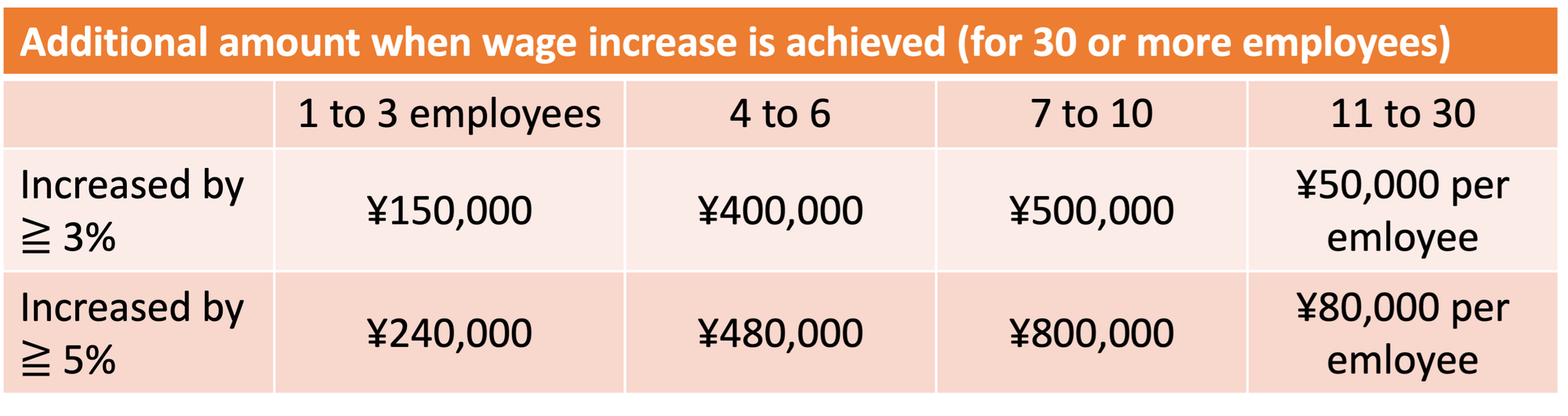

[Grant details and amount] A wide range of expenses related to work style reform are eligible. 75% of eligible costs or 80% for companies with 30 or fewer employees that spend over ¥300,000. Successful completion of Outcome Goal 1 qualifies for a grant of ¥2 million maximum, plus potential additions for wage increases.

'Outcome Goals' and other conditions

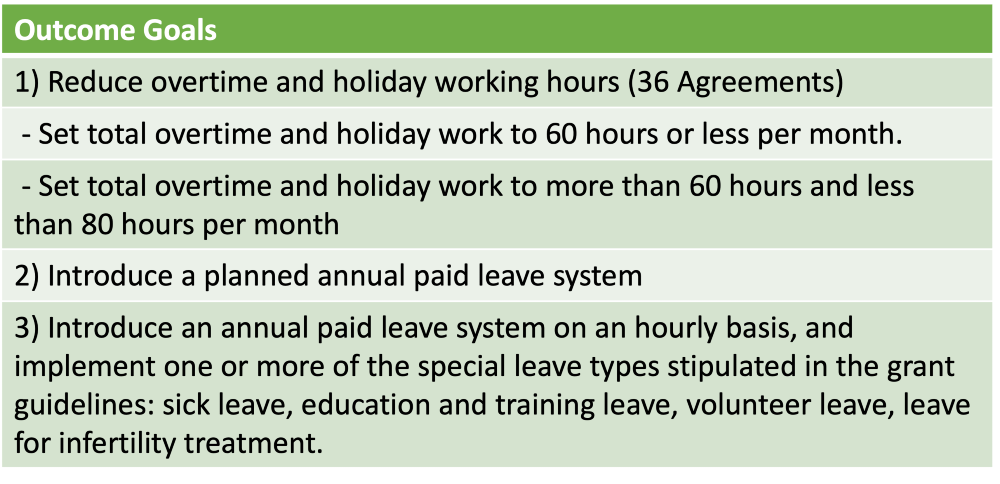

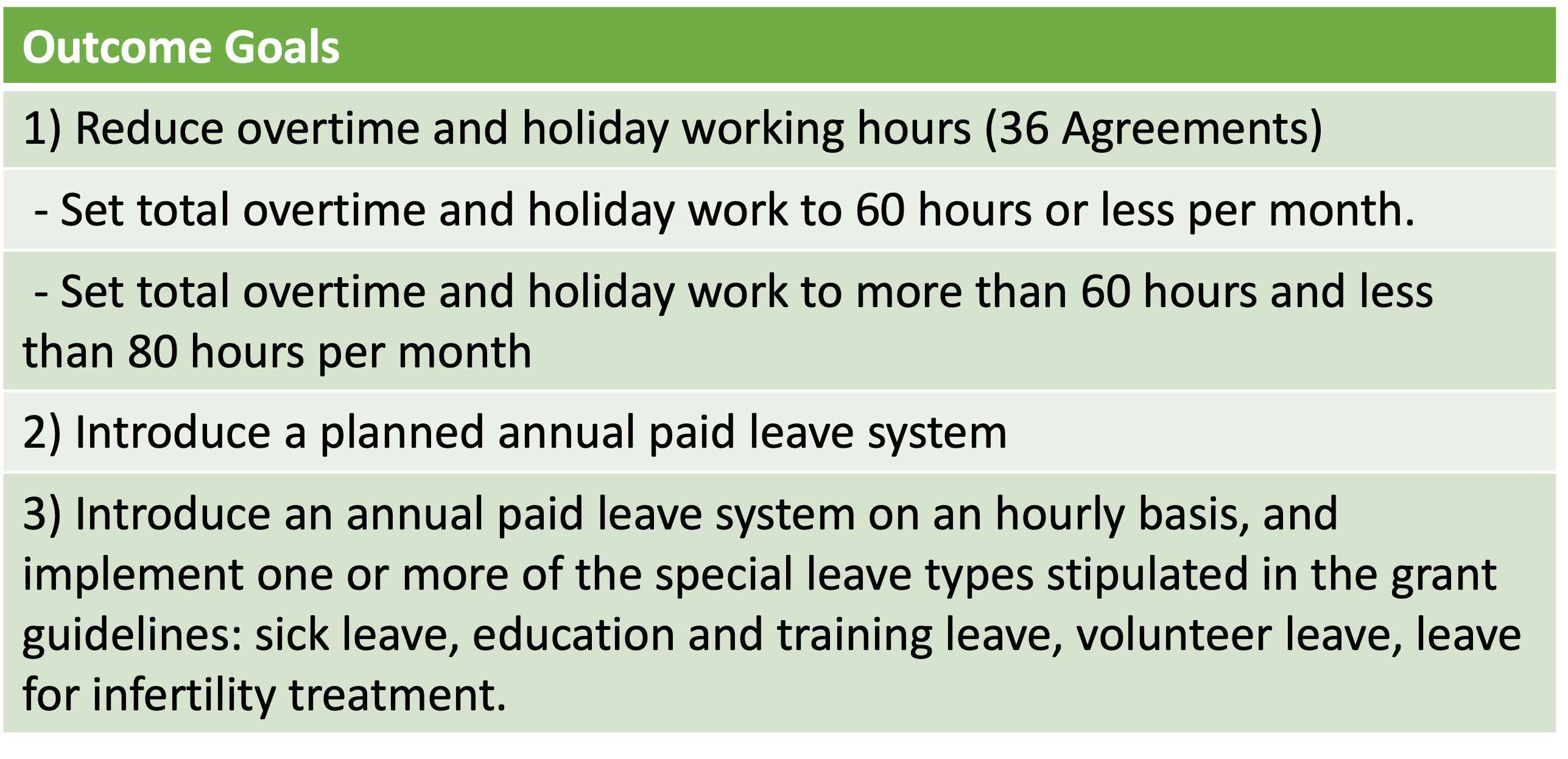

To receive the grant, companies must meet one or more of the following 'outcome goals':

For details, see the next section.

[Eligibility] Companies must set and achieve 'Outcome Goals' (see below). Attendance records (出勤簿, or shukkinbo) and wage ledgers (賃金台帳 or chingin-daicho) are also required.

[Eligible Businesses] Small and Medium-sized Enterprises (SMEs) that meet all of the following criteria:

- The company is covered by workers' compensation insurance.

- The business meets more than one of the requirements for Outcome Goals 1, 2, and 3

- At the time of grant application, all the workplaces have written policies and procedures in place that guarantee employees at least 5 days of annual paid leave.

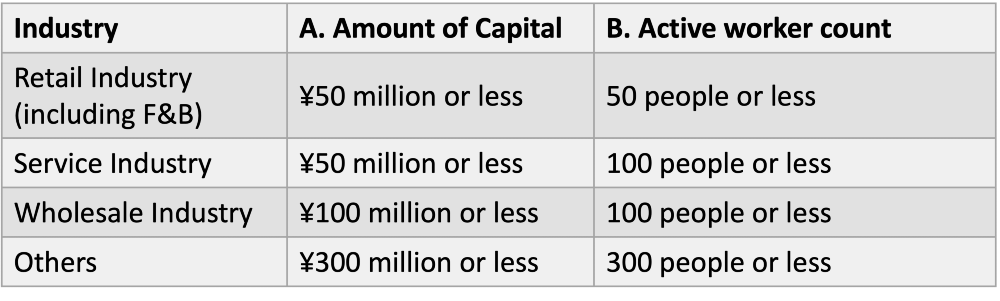

SME Definition: A business qualifies as an SME if it meets either A or B of the following criteria:

[To receive the grant: Act now] Employers must review the annual paid leave clause in their work regulations and the agreement on overtime and holiday work ('36 agreement', or 36 kyotei) as soon as possible. To be eligible for the next fiscal year, starting in April, complete at least one of the outcome goals above by the end of this fiscal year in March 2025. These changes will be applied from the next fiscal year.

Grants for a wide range of expenses up to ¥2m

This grant is 'easy to use', according to Narai, an experienced sharoshi, a social insurance labour consultant. However, there are certain tasks that must be completed by the end of the fiscal year in order to apply in the next fiscal year, starting in April. For those interested in learning more, he gives us an overview of the grant and its requirements.

Q: I understand this grant is highly recommended. It has a wide range of applications, correct?

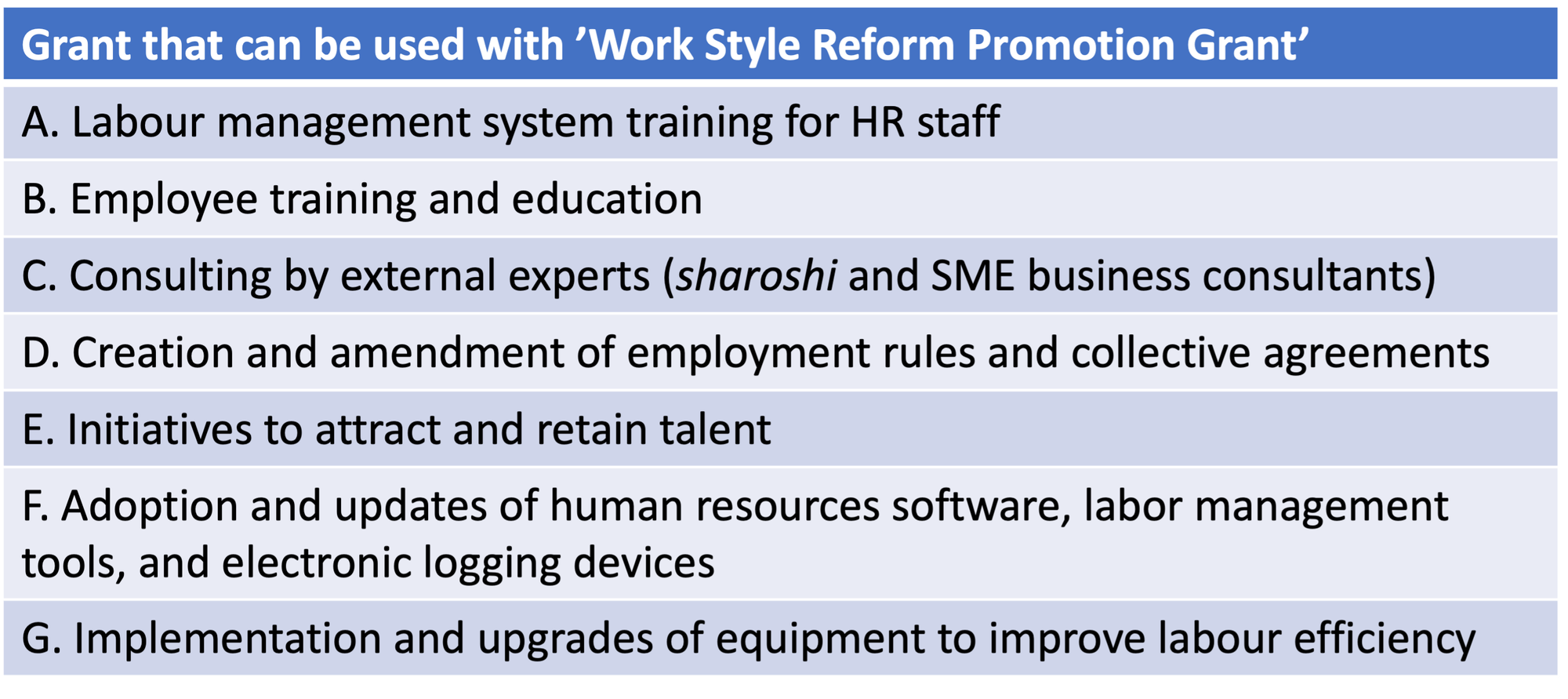

Tomohiko Narai: Here's the list of some examples of eligible expenses.

Item G is particularly easy to use. These can include things like dishwashers for F&B businesses, or employment management systems for a company's administration department. Cars may also be eligible, as long as you can show that they will lead to increased productivity, no matter what industry you are in.

This grant programme aims to support businesses investing in productivity-enhancing measures. Expenses that are likely to result in increased efficiency, improved workflows, or enhanced output may be eligible for funding.

It's important to note that simply spending the money isn't enough to qualify for the grant. The grant is awarded only when at least one of the outcome goals outlined below (repeated figure), from (1) to (3), is achieved.

Q: By what criteria can we define an achievement?

TN: 'Achievement' is defined as simply making changes to the 36 Agreement or employment regulations. It does not require an actual reduction in working hours or an increase in the rate of paid work.

Specifically, the item (1) refers to the 36 Agreement, where the upper limit for the subsidy is ¥2 million if the working hours are within 60 hours from the current limit of more than 80 hours. The grant covers 75% of eligible expenses, or 80% if the company has less than 30 employees and purchases items costing ¥300,000. For the items (2) and (3), the upper limit is ¥250,000 each.

Make sure to ensure annual paid leave through employment regulations

Q: What are the specific steps involved in applying for this grant?

TN: There are two main requirements. Firstly, you need to review your employment regulations and ensure they include a clause about annual paid leave. Specifically, the regulations must state that employees with 10 or more days of annual paid leave are entitled to:

- Have their opinions heard regarding when they'd like to take 5 days of leave.

- Have those 5 days designated in advance (within one year of the leave being granted). If an employee takes their own paid annual leave, those days will be deducted from the aforementioned 5 days.

Secondly, the required wording is contained within the special clause (which is akin to the second page) of the 36 Agreement. This special clause features a column for specifying the total monthly overtime and holiday work hours, which in most instances is 'up to 80 hours'.

Q: When must companies amend my 36 agreement?

TN: It must be amended by 31 March this year; if the 80-hour limit is exceeded after 1 April, the grant will not be applicable. Additionally, as a prerequisite, you will require attendance records and wage ledgers. It is advisable to prepare these with the assistance of a sharoshi.

Q: Can expenses be claimed for items purchased during the current financial year?

TN: No, expenses cannot be claimed for items already purchased. Please note this carefully. Ensure that you submit the grant implementation plan after April, and only purchase items after the Department of Labour has approved it.